Margin loan on 401k

For example if an investor has 10000 in a margin trading account they could potentially purchase up to 20000 of stock by borrowing the remainder of the required. With the 100 additional shares you bought on margin your total portfolio is worth 6000 200 total shares times 30 price.

/ibkr3-e0bbfb89f38748e8871d5b461047ac2b.jpg)

Interactive Brokers Review

At the start each buyer uses the identical amount of cash.

. For example if you have 5000 cash in a margin-approved brokerage account you could buy up to 10000 worth of marginable stock. Our margin rates are among the most competitive in the industryas low as 625. Yes provided that you are both working in the same.

Margin accounts allow you to borrow against the value of stocks and other investment securities in your account and you can use borrowed cash for personal purposes. You sell and pay back 5000 plus 400 of interest 1 which leaves you with 8600. Once approved you can begin using the funds right away.

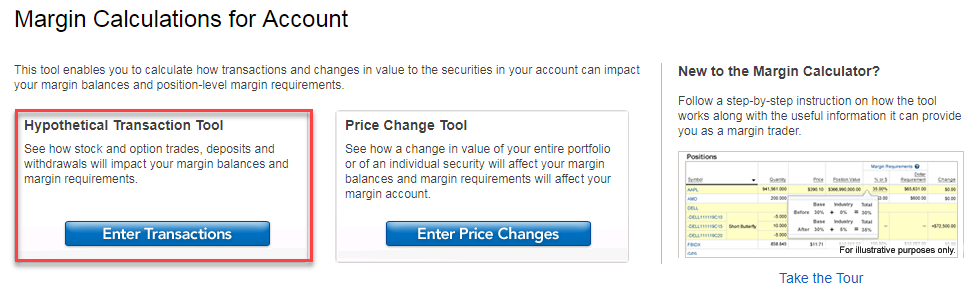

You would use your cash to buy the. 10575 1250 above base rate 625 rate available for debit balances over 1M. Fidelitys current base margin rate effective since July.

Each brokerage firm sets its own margin rates but theyre often. View our margin rates. Of that 3600 is profit.

10075 0750 above base rate 024999. Just like any other loan a margin loan requires that you pay interest on the amount youve borrowed. But the investor who also uses a margin loan purchases twice as many shares.

If you decide to sell at this point you still have to pay back the. Some securities cannot be purchased on margin which means they must be purchased in a cash account and the customer must deposit 100 percent of the purchase. Posted Nov 28 2020 1347.

We can both be considered self employed. So in the first case you profited 2000 on an investment of 5000 for a gain. A margin loan from Fidelity is interest-bearing and can be used to gain access to funds for a variety of needs that cover both investment and non-investment needs.

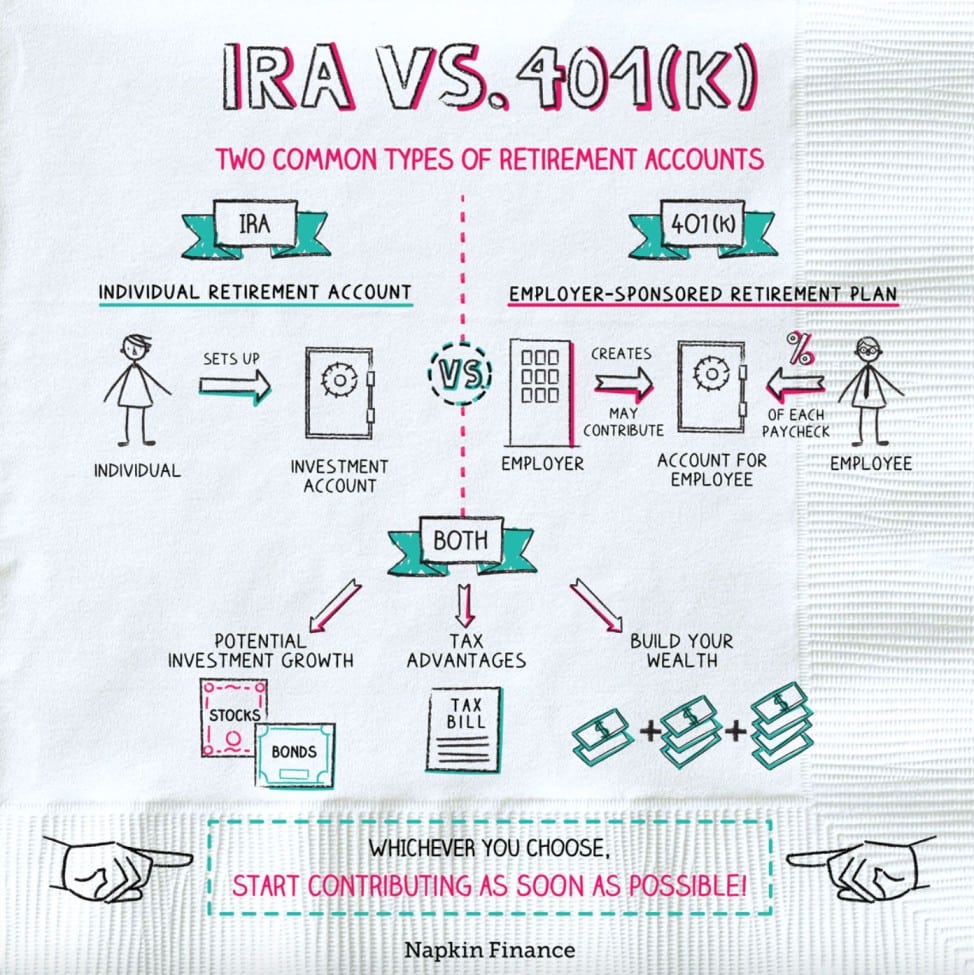

401k IRA Margin Loans. There will be no problem with me and my wife both getting a solo 401k right. Reducing the Asset by the Amount.

When loans are secured by the borrowers financial assets monthly payments for the loan do not have to be considered as long-term debt. Im looking into different ways to fund deals and am curious about using. Watch what happens when the price of XYZ.

Using A Margin Loan Versus A Mortgage To Purchase Property

How To Invest 50k Online In September 2022

Ubit Margin Accounts And The Solo 401k Solo 401k

Trading Faqs Margin Fidelity

Trading Faqs Margin Fidelity

What You Need To Know About 401k Administrators For Small Business

Trading Faqs Margin Fidelity

Trading Faqs Margin Fidelity

Ubiquity 401 K Plan Review An Option For The Self Employed How To Plan Credit Counseling Debt Snowball

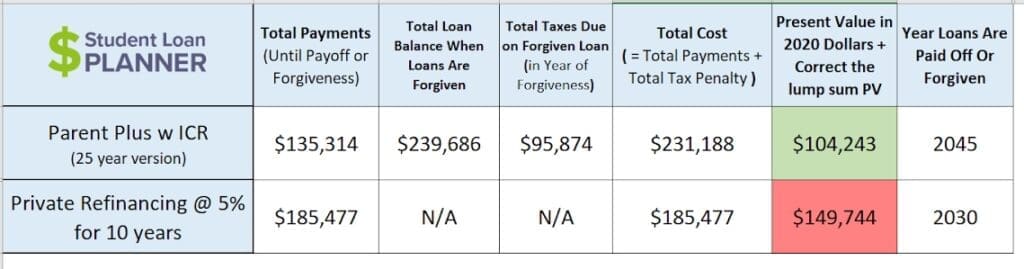

The 5 Best Ways To Pay Off Parent Plus Loans Student Loan Planner

Fidelity Investments What Is A Margin Account Youtube

Personal Line Of Credit Short Term Needs Edward Jones

Plastiq Eligibility Chart Supported B2b Payment Types On Plastiq

Ubit Margin Accounts And The Solo 401k Solo 401k

Securities Based Lending Ameriprise Financial

Trading Faqs Margin Fidelity

Fidelity Investments What Is A Margin Account Youtube